Why Bitcoin is Different from All Other Cryptocurrencies

A common belief that's still taboo in many rationalist circles

As a software engineer at Google, I spent a lot of time reading and writing design documents. The format used by our team - Datacenter Software - was called “why, what, how.”

The documents were structured like this:

Why: Describe the problem you are trying to solve. Give the current approach and explain its shortcomings.

What: Describe the proposed new solution at a very high level.

How: Go into detail on the components of the proposed solution and how they all fit together.

The simplest way to explain why bitcoin is different from all other currencies, an increasingly common belief1, is to use the ‘why, what, how’ format to imagine we are building a design doc for a cryptocurrency. We can then compare the “design docs” for Bitcoin with every other cryptocurrency’s design doc.

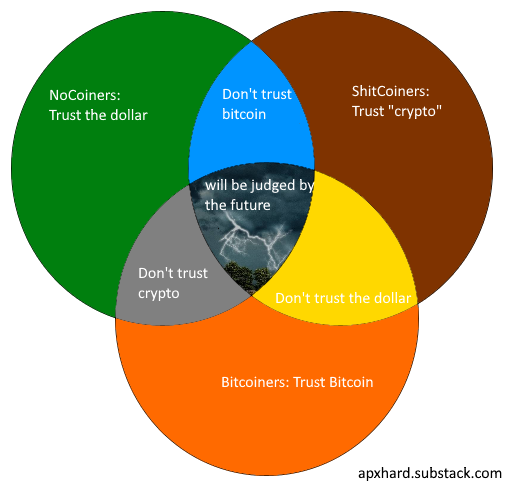

At this point, you may be thinking: cryptocurrency is a bunch of stupid scams. Why should I care? As a bitcoin maximalist, I agree with you. You and I are more alike than we are different. The only real difference is that, when you look at ‘crypto’ you think ‘this is a landscape of stupid scams based upon technology that, although neat, was a solution in search of a problem’. I see the exact same thing except I know that bitcoin is different.

What comes out of this process is that bitcoiners end up sounding much more like ‘cryptocurrency skeptics’, who are skeptical of all cryptocurrencies except bitcoin, than they do cryptocurrency fans:

So what’s the problem that bitcoin was created to solve, and ‘cryptocurrencies’ have generally ignored?

Why (Crypto Version):

Because, bitcoin is cool, but it’s not cool enough! We could make an even cooler thing than bitcoin if we change bitcoin to fix some problems with bitcoin. Bitcoin showed that cryptocurrencies are possible, but it’s controlled by a superconservative old guard who won’t change anything because they got in early and just want to keep things the same. Bitcoin is now old and slow and we can do better so that cryptocurrencies like bitcoin can be faster/cheaper for making payments/more environmentally friendly/able to support more elaborate smart contracts.

The new thing will be just like bitcoin, except better!

This is the kind of argument that junior engineers often make: “Let’s build this cool thing!” OK, what problem does it solve? “Well, bitcoin has these issues...” If you are already sold on bitcoin, then maybe this argument makes sense2. The thing is, most people still don’t see the problem bitcoin set out to solve in the first place.

Most first world adults see cryptocurrency as “a problem in search of a solution.” Even in the rationalist community, which prizes itself as being open minded and willing to consider evidence, a leading blogger known for being open minded and fair decided to say that he was “less than infinitely hostile” to cryptocurrency instead of saying he thinks it’s doing an OK job of solving a real problem. This only makes sense: these people see a whole bunch of unsustainable scams based upon “digital dog money” and people selling stupid jpegs to each other, and think, “wow, this is dumb.”

I agree with you. NFT’s are dumb. Web3 is a venture capital buzzword. DeFi was used primarily to fund a network of ponzi-casinos, with large projects straddling the line between motivated cluelessness and deliberate fraud. I agree with all of this, and see these as being separate from bitcoin because those things aren’t solving the problem bitcoin was created to solve.

Well, what problem is that?

Cryptocurrency enthusiasts aren’t the ones to tell you what that problem is, because once you realize the problem Bitcoin was created to solve, you also will realize that these cryptocurrencies don’t actually solve the problem. Only bitcoin possibly can.

Why (Bitcoin Version):

Because fiat money is deeply unfair and is changing in ways that directly threaten democracy and human rights.

Big banks took huge risks in 2008, and when they won, they kept the money for themselves. When they lost, they took bailouts from the public. Money that can be created easily will be created with increasing frequency. That newly created money will go to the friends and allies of the people that printed the money.

Money printing rewards political insiders and hurts everyone else. Money printing and a currency that loses value over time encourages people to ‘invest’ in things they don’t understand, and rewards people who have assets, simply for being in possession of those assets.

The problem is already bad enough, but without some big change, it will get dramatically worse. Central Bank Digital Currencies will give governments the ability to create a financial panopticon and exercise immense power over their citizens. Even in supposedly democratic states like Canada, the government has given itself the ability to seize bank accounts of political protestors, while government-funded journalists cheered them on, spreading lies about the protestors.

Reasonable people look at China’s social credit score and think, “that looks like a dystopian nightmare.” Our regulators and politicians look at China’s apparatus of social control and think, “I want that.”

The most important thing we can do to ensure human flourishing in the next century is to have money that no one can possibly control. Bitcoin is our only hope for this outcome. If anyone can control money itself - either to print it to give to their friends, or to stop people from transacting or owning anything - that person will become a tyrant.

Fiat money is headed towards being a tool for total surveillance and subtle and overt political control. The warning signs are here. They are obvious to anyone paying attention.

This is the problem Satoshi Nakamoto set out to solve. This is the problem bitcoin has solved: money that the state can’t seize from you without enormous difficulty, or even at seize all, if you secure it correctly.

That’s the “why.” Because fiat money is already deeply unfair, and it is moving in a tyrannical direction. Now that we’ve covered the problem we set out to solve, let’s talk about what a solution looks like.

What (Crypto):

a decentralized network, where decentralized means ‘there are lots of computers involved’

it should have the ability to do things like smart contracts

it should be fast, enough to support hundreds or even thousands of transactions per second

it should not use a lot of energy

it should be easy to use, so that even people with minimal programming experience can write smart contracts

What (Bitcoin):

a permissionless, open, decentralized network, where ‘decentralized’ means nobody single person or group has authority over any aspect of its operation

no, you don’t get it yet, it really has to be permissionless and decentralized

literally nothing is more important than the ‘decentralized, open, permissionless’ requirement, if you screw this up, the network will end up being taken over by governments, who will do their best to take it over once there’s a viable alternative to fiat currencies given runaway inflation

It turns out that it’s really, really hard to avoid screwing this up, people tried to find a solution for decades but couldn’t overcome the problem of requiring there to be some entity that you must trust

No, you still don’t understand just how difficult of a technical problem it is to make sure that there isn’t some group of actors with the ability and incentive to control the network. Distributed systems is an extremely tricky computing domain where mistakes are easy to make.

The best we can do is to make sure that nobody takes over the network is to make sure that anyone with the ability to do so has no incentive to do so, which is of course not a guarantee but that’s probably the best anyone can do

Other stuff? Yeah, sure, whatever. Only if it doesn’t risk the core value proposition of being a decentralized, permissionless network. Neither transaction speed nor user friendliness nor cost of transactions nor energy usage nor throughput nor a risk of summoning the Outer God Yog-Sothoth - none of that matters if you put decentralization at risk.

Hopefully, this makes the point clear.

Bitcoiners have Always Had Different Values

While “crypto users” were out shilling DeFi, talking about “yield farming” and telling everyone about Terra/Luna and FTX, bitcoiners kept repeating:

Not your keys, not your bitcoin. If you don’t hold the private keys, you have an IOU, not real bitcoin.

Don’t trust any exchange to be honest. Take your coins off of the exchanges.

Anyone offering 10% interest is clearly running, at best, an unsustainable business. At worst, they are running a scam.

Before Terra and Luna blew up, Bitcoin Maximalists were saying stuff like this:

While “cryptocurrency enthusiasts” were saying this:

What about Ethereum? How is Ethereum a Scam?

If we look at the one criterion that matters (is it, or can it be, captured and controlled) consider:

There is an “Ethereum foundation,” which raised the initial funding to create Ethereum, and to this day, coordinates changes to the Ethereum code base

The Ethereum foundation consists of persons who could be overtly or covertly pressured by governments

Ethereum promised “code is law” and then, when someone ran code that exploited a flaw in a major smart contract, the Ethereum Foundation asked major exchanges to stop trading Ethereum so they could roll the blockchain state back

50% of all Ethereum were created at launch, either for early investors or for the Ethereum foundation itself.

The consensus mechanism that Ethereum switched to, ‘proof of stake’ simultaneously rewards large holders of Ethereum and allows them to decide which transactions are and are not valid. Nothing would ever force these people to give up control over Ethereum.

There’s a foundation that created the coin, profited from its creation, and has exercised control over the coin, even doing things like reverting the state of the Ethereum blockchain. The initial creation of coins still exceeds the new supply, meaning that coins created when the Ethereum blockchain first started are sufficient to dominate the staking pool.

If bitcoin miners can’t pay their bills in real life, by selling their newly mined bitcoin, they have to stop mining. No miner can keep mining, indefinitely, without paying heavily for the privileges to do so. There is no class of permanently ensconced miners who will dictate bitcoin’s future. Indeed, Many miners will go bankrupt. No permission from bitcoin holders is necessary to mine bitcoin. Anyone can buy a miner, plug it in, and turn it on, even if every holder of bitcoin hates them.

To participate in Ethereum’s proof of stake, meanwhile, you have to buy Ethereum from someone else who is willing to sell you their Ethereum. To participate, at scale, in Ethereum validation, you need the permission of big Ethereum holders, which they need never give up if they don’t want to. No Ethereum stakers will ever go bankrupt due to the costs of staking. It gets worse than this. See a longer argument with more details here.

Ethereum validation is a permissioned network that either is already, or will likely be controlled by the Ethereum foundation and initial investors, because over 50% of the total Ethereum in existence were created on day one. These people, even if they are entirely noble, can and will be coerced by governments into adding the kinds of surveillance and censorship that politicians want.

The reality is this: lots of people got excited about ‘number go up.’ Very few of them cared as much about keeping the system ownerless; these people went on to create their own coins. Only the people that valued bitcoin being a decentralized, permissionless network above all else stuck with bitcoin.

This is what separates bitcoin from all other cryptocurrencies: a values system that says, “Don’t come anywhere near putting decentralization at risk. If bitcoin doesn’t change, at all, ever, that’s fine, it’s a better outcome than changing bitcoin in a way that makes it possible for some state or business to capture it.”

What about the Environment? You are Raping the Earth!

No.

In fact, there are good reasons to believe that bitcoin is good for the environment.

You’ve been told bitcoin uses an “absurd amount of energy.” This is from people who think it doesn’t solve a problem. If bitcoin really did solve the problem of “preventing democratic nations from stealing from their citizens”, how much energy usage would that justify?

Even if all bitcoin did was tiddle the fancies of internet weirdos, look how little it uses on a global scale:

When was the last time you heard people getting angry about the energy used by gold mining and jewelry manufacturing? If you’re going to be a rationalist, you have to compare the best arguments for an against a claim. So yes, bitcoin does contribute some carbon emissions to the atmosphere. But it not only solves a problem for people who care about human rights, bitcoin also helps the environment!

Bitcoin Helps the Environment and Stabilize Energy Grids

Bitcoin is currently used to capture natural gas from oil mining operations that would otherwise be flared. The captured gas is then combusted more efficiently, reducing the net carbon emissions.

People are also exploring using bitcoin to capture methane emissions, which would make these operations net negative carbon emissions because methane is so much worse than carbon.

Bitcoin also functions as a reliable buyer for renewable power, making it more cost competitive. Bitcoin mining made it economically viable to turn the world’s oldest hydroelectric plant back on. Bitcoin miners act as willing buyers for any renewable power sources from the moment they are set up, improving the incentive for anyone constructing new sources of renewable power. Fossil-fuel burning plants can simply burn less fuels at times of low demand. Wind and solar power generation systems don’t have this benefit, and so they sometimes offer negative energy prices to encourage customers to use more energy. Bitcoin fixes this, making renewable energy sources more cost competitive.

Bitcoin also functions as a mechanism for energy stability, by being a user of power that’s willing to turn off at a moment’s notice. Grid operators can build to support excess capacity in most conditions, with bitcoin mining paying the bills. When extreme heat emergencies arise and the need for power spikes way above baseline, the bitcoin miners can shut off instantly.

Bitcoin incentivizes people to seek out and develop stranded energy anywhere on earth. The idea that we are going to save the environment by reducing energy usage is ludicrous. It is scientifically and economically illiterate, since energy usage is directly tied to wealth and quality of life.

The way to save the planet from global warming without sacrificing human rights and human dignity is not to beg, or force people to use less energy, but to bring more clean energy to market. Bitcoin does exactly that. I don’t know much about fusion power, but I know this: literally the moment they turn that first fusion power plant on, they’ll be able to sell every watt of power they can generate to customers who’ll happily pay just below market price.

What do you think “infinite demand for energy below the current market price” does for investors considering funding low-emissions energy projects?

The ability of human beings to bend the universe to our will is constrained, only, by two things: the energy we can control, and the skill with which we wield it. Bitcoin, by creating an unlimited demand for cheaper energy, creates a mechanism to push against the tightest of constraints preventing humanity from flourishing.

Nobody is as Optimistic about the future as Bitcoin Maximalists

The bitcoin maximalist stance is as follows:

bitcoin was a fundamental breakthrough in theoretical computer science, enabling an open permissionless network to achieve consensus on socially constructed facts, leading to the possibility of money that no state, corporation, or person can control

bitcoin’s price went up and this drew in a lot of people who were curious, wanted to make money, and most of whom didn’t understand the technology

lots of people who didn’t really understand the difficulty of ‘distributed consensus with byzantine fault tolerance on a permissionless network’ thought ‘I could do better’ and sold projects with varying levels of sophistication to people who didn’t know any better

meanwhile, bitcoin slowly, gradually, safely improved due to a community that prioritized bitcoin’s decentralized, permissionless nature over every other property that might be desirable.

bitcoin’s proof of work mechanism, far from being an environmental catastrophe, is simultaneously a subsidy for renewable energy sources, an incentive to produce more energy, a mechanism for capturing harmful green house gasses, and a mechanism for stabilizing energy grids

I’ve been talking people about bitcoin for close to a decade now. When I started having these conversations, nobody thought inflation was a serious problem. Nobody worried that democratic states might seize the funds of peaceful protestors. Nobody thought that geopolitical instability was on the horizon. I have figured, for almost a decade now, that this trend would continue:

My experience has been, for the past decade, is that even very intelligent, reasonable people think I’m crazy. That hasn’t really changed. But what has changed is the number of reasons they give for saying I’m crazy. People no longer tell me I’m crazy to worry about inflation, or democratic governments seizing funds of peaceful protestors, or geopolitical instability. But, still, they often think I’m crazy for thinking the above trend will continue.

Is that really crazy?

If you’re a rationalist, perhaps ask yourself: if what I’m saying is true - what would the world look like? If I were right, what would you expect to see?

If I were correct, how would the world look different from the way it currently does?

If you can think of something I should be seeing, but I’m not, please, share it in the comments.

Here is a list of business leaders and regulators who are all in agreement: Bitcoin is different from the rest of cryptocurrencies.

Fidelity Investments says, “ investors need to consider bitcoin separately from other digital assets. No other digital asset is likely to improve upon bitcoin as a monetary good because bitcoin is the most (relative to other digital assets) secure, decentralized, sound digital money and any “improvement” will necessarily face tradeoffs. ”.

Morgan Stanley says bitcoin’s lightning network can rival or even surpass the Visa payment network.

Square CEO Jack Dorsey is only interested in bitcoin.

A New York Times Article about bitcoin maximalists.

The SEC Chair Gary Gensler says only Bitcoin is a commodity. CFTC Chair Rostin Behnam agrees.

It doesn’t. All of the “flaws” and “shortcomings” are either intentional design choices, or things that have since been improved by bitcoin’s Layer 2 “lightning network”, which Morgan Stanley says could surpass Visa in terms of its throughput and cost.

The Ethereum smart contract example is another good example. Bitcoin was made intentionally not Turing complete because Turing complete systems are much harder to reason about and formally validate.

Problem with bitcoin - it doesn't represent anything of value but faith ( fiat) and computation invested

Fiat currencies represnt faith + economies + propaganda+ military backing it. Thats why us dollar is worth something despite all the printing - if all else fails us will make you accepts its currency by force.

Tokens on crypto secure blockchain is great tech. But without anything tangible tied to these tokens its still fiat. And very lightly backed at that

Ok; you made clear how bitcoin is different from Ethereum. But how is it different from other PoW coins that offer no financial rewards for their creators and are less geared toward speculation than Bitcoin is?